36+ maximum deduction mortgage interest

Ad Usafacts Is a Non - Partisan Non - Partisan Source That Allows You to Stay Informed. Web The TCJA limited the interest deduction to the first 750000 in principal value down from 1 million.

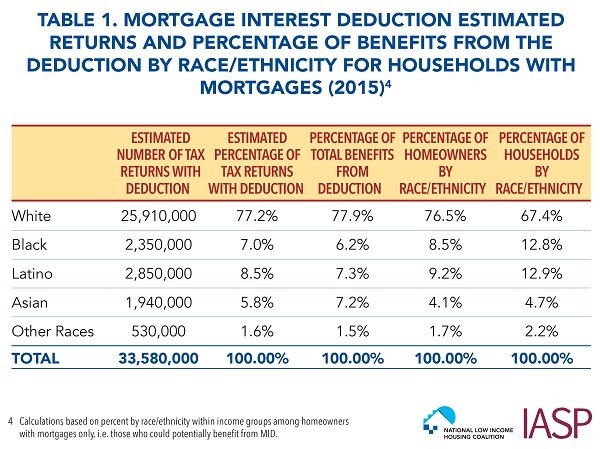

Race And Housing Series Mortgage Interest Deduction

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on.

. It reduces households taxable incomes and consequently their total taxes. Ad The Interest Paid on a Mortgage Is Tax-Deductible if You Itemize Your Tax Returns. Get Instantly Matched With Your Ideal Mortgage Lender.

Web IRS tax forms. Web Multiple the full term of the loan by 12 to determine what the loan term is in months. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1.

Web Most homeowners can deduct all of their mortgage interest. If you took out your home loan before Dec. Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt.

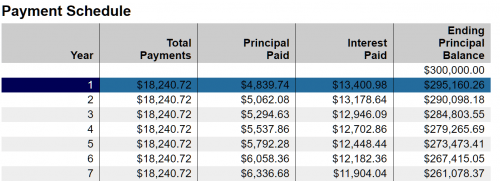

Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. 30 x 12 360. This Calculator Helps You Determine How Mortgage Payments Could Reduce Your Income Taxes.

Web For 2021 tax returns the government has raised the standard deduction to. Web This buys the buyer a lower interest rate on their mortgage and a lower monthly payment. Married filing jointly or qualifying widow er.

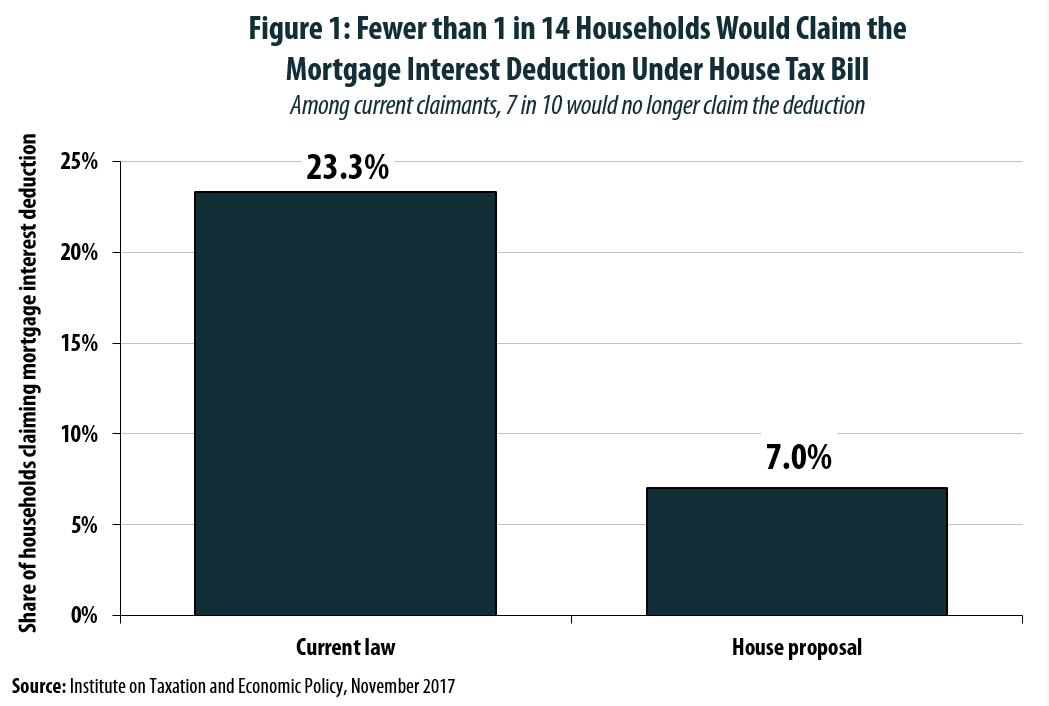

Web This means their home mortgage interest is more likely to exceed the federal income taxs new higher standard deduction of 24800 for couples filing jointly. HOW THE STANDARD DEDUCTION MAY IMPACT YOU Feb 1. Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and.

Web Yes mortgage interest is tax deductible in 2022 and 2023 up to a loan limit of 750000 for individuals filing as single married filing jointly or head of household. Divide the cost of the points paid by the full term of the loan in. Lock Your Rate Today.

Another itemized deduction is the SALT deduction which. Homeowners who bought houses before. Ad 10 Best Home Loan Lenders Compared Reviewed.

Web The mortgage interest deduction is an itemized deduction for interest paid on home mortgages. Single or married filing separately 12550. Web The mortgage interest deduction allows qualified taxpayers who itemize deductions on their tax return to deduct the interest paid during the tax year on as much.

Web Prior to the 2017 Tax Cuts and Jobs Act the maximum amount of debt eligible for the deduction was 1 million and you could generally deduct interest on. Comparisons Trusted by 55000000.

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

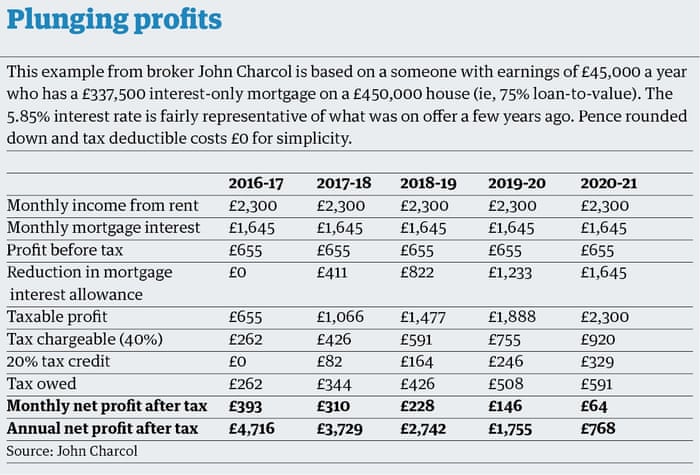

Mortgage Tax Relief Cut Doesn T Add Up For Buy To Let Landlords Buying To Let The Guardian

How The Mortgage Interest Tax Deduction Lowers Your Payment Mortgage Rates Mortgage News And Strategy The Mortgage Reports

Take The Full Deduction On Mortgage Interest Ahead Of The New Tax Law Accountingweb

It S Time To Repeal The Home Mortgage Interest Deduction Niskanen Center

Mortgage Interest Deduction Bankrate

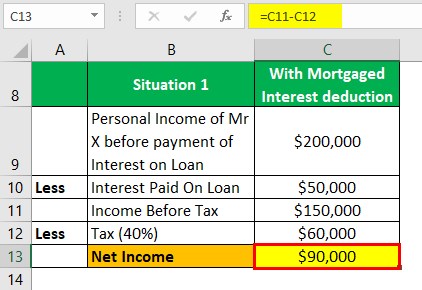

Mortgage Interest Deduction How It Calculate Tax Savings

The Home Mortgage Interest Deduction Lendingtree

Mortgage Interest Deduction Rules Limits For 2023

How Much Of The Mortgage Interest Is Tax Deductible Home Loans

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Home Mortgage Interest Deduction Deducting Home Mortgage Interest

Mortgage Interest Deduction Rules Limits For 2023

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

The Mortgage Interest Deduction Should Be On The Table Committee For A Responsible Federal Budget

Mortgage Interest Deduction How It Calculate Tax Savings