Medical retirement calculator

In most cases you cant tap tax-deferred retirement plans without a 10 percent penalty until the year you turn. There are two sides to the retirement planning equation saving and spending.

Va Disability Pay Schedule 2022 Update Hill Ponton P A

This calculator takes an account balance and interest rate and determines either how long you can withdraw a fixed amount of money from it or how much you can withdraw over a fixed amount of time.

. The three basic retirement categories for military members include. Your household income location filing status and number of personal exemptions. For example if you or your spouse have a chronic medical condition you may want to save more.

The federal government will collect estate tax if your estate has a value of more than the federal estate tax exemption. The sooner you start planning for retirement the more money you can invest for the long term. It provides you with two important advantages.

The military retirement system is well documented and understood in general but some mystery surrounds medical disability retirement even among currently serving troops. You only pay taxes on contributions and earnings when the money is withdrawn. Get the basics on retirement planning and pension benefits such as how Social Security works retiring from the civil service and managing a private pension.

Individuals with certain pre-existing medical conditions may not be eligible for the full coverage above but may instead receive less coverage. The retirement readiness calculator is intended to provide a ballpark estimate and is for informational purposes only. Get 247 customer support help when you place a homework help service order with us.

Paychex Retirement Calculator Information. Use our retirement calculator to help you understand where you are on the road to a secure retirement. JavaScript is required for this calculator.

Maintaining a Benefit Postal Disability Retirement. Retirement Payout Calculator. Vacation Expenses on.

What Expenses Can You. You may need to consult with a financial or tax professional for more. Use this convenient calculator to see the income youll need to retire.

We use the Social Security Administrations National Average Wage Index to index wages for the social security benefit calculation Working Years. A Disconnect Between the Legal and the Medical FERS Disability Retirement Law. It may surprise you how significant your retirement accumulation may become simply by saving a small percentage of your salary each month in your 401k plan.

Further it may be useful to estimate your future monthly income generated by these savings and what that means in todays dollars. Three Military Retirement Categories. The Thrift Savings Plan TSP is a retirement savings and investment plan for Federal employees.

By the time Tim retires hell have 698314 in his retirement account. It offers Federal civilian employees the same type of savings and tax benefits that many private corporations offer their employees under 401k plans. Use a retirement calculator to find out the.

Because retirement investing can be so difficult MarketBeat has a new easy-to-use tool that can help you see what. If youd like to save even more for retirement consider opening an individual retirement account which gives you another 6000 in tax-advantaged contributions or 7000 if youre 50 or older. A 401k can be one of your best tools for creating a secure retirement.

Second many employers provide. If you are using Internet Explorer you may need to. The purpose of the TSP is to provide retirement income.

We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Gift Tax and Estate Tax. Then well recommend an action plan you can follow to reach your goals.

Use our retirement calculator to see how much you might save by the time you retire. Top 10 Ways to Prepare for Retirement. All insurance products are subject to state.

We assume that you have worked and paid Social. Our income tax calculator calculates your federal state and local taxes based on several key inputs. If you plan on retiring early however youll need a lot of money.

The exemption for 2022 is 1206 million. Use this calculator to help determine what size your retirement nest egg should be. Enter your account balance.

Find information about health care health insurance long-term care insurance disability coverage vision and dental insurance. Health Care Expenses on hospital visits medicines medical tests gym subscriptions etc. Retirement Withdrawal Calculator Insights.

Medical expenses also include amounts paid for qualified long-term care services and limited amounts paid for any qualified long-term care insurance contract. It is better to start planning the retirement funds needed for a stress-free lifestyle post-retirement and start investing in it. In the last 40 years the emergence of the individual retirement account IRA 401k Roth IRA SEP IRA and other investing tools have made saving for retirement accessible for a large part of our population.

A Retirement calculator is an online tool that helps in determining the retirement corpus. Reserve component military. First all contributions and earnings to your 401k are tax-deferred.

Changing the Goalposts Just Because OPM Says So Doesnt. This retirement calculator requires some basic inputs from your side such as your retirement age life expectancy inflation expected return on investments your current portfolio size and expected retirement expenses. When should I retire.

Tell us a few things about yourself and this calculator can show whether youre on track for the retirement you want. Saving for retirement is the biggest objective of investors. The asset accumulation phase saving leads up to your retirement date followed by the decumulation phase where you spend down those assets to support living expenses in retirement.

Buy a small second apartment if. Heres your retirement calculator. Understanding the Basics of a FERS Disability Application A Federal Disability Attorneys Approach FERS Disability Retirement.

At the same time the exemption for your estate may not be the full 1206 million. We assume that your income in the future increases by the rate if inflation and your income in the past is discounted by the same inflation rate Indexed Earnings. Active component military retirement.

Also we separately calculate the federal income taxes you will owe in the 2020 - 2021 filing season based on the Trump Tax Plan. Enter desired number of years or desired monthly payout below. The AARP Retirement Calculator will help you decide.

The earlier you start contributing to a retirement plan the more the power of compound interest may help you save. How much retirement income may my 401k provide. Buy medical insurance for the medical insurance and claim the deduction on the premium.

Do you know how much it takes to create a secure retirement. Medical expenses include the premiums you pay for in-surance that covers the expenses of medical care and the amounts you pay for transportation to get medical care.

Crdp And Crsc Concurrent Receipt Explained Cck Law

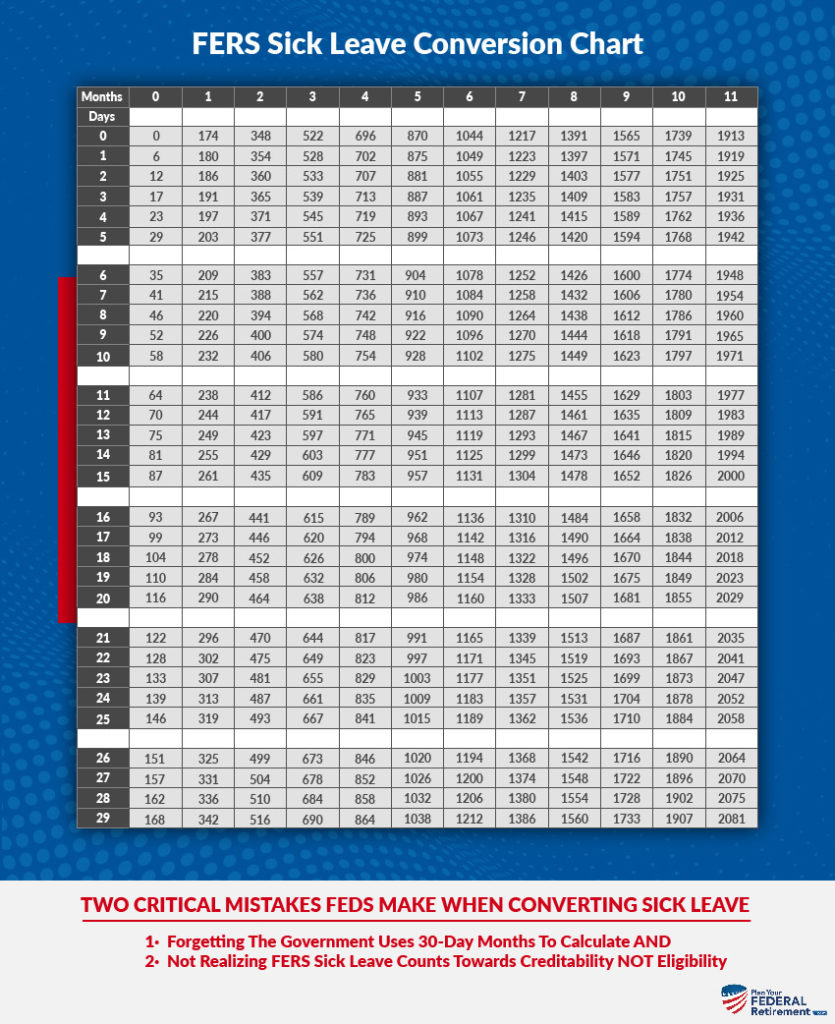

Fers Retirement And Sick Leave Plan Your Federal Retirement

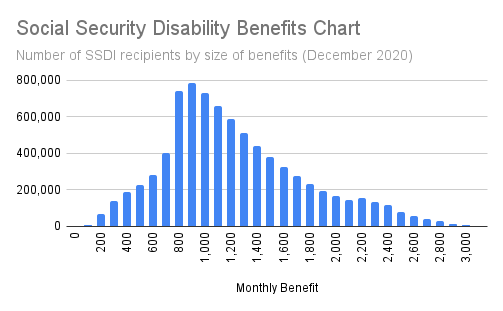

How Much Would You Receive From Disability Benefits Washington Post

Military Compensation Pay Retirement E7with20years

Estimate Your Benefits Arizona State Retirement System

2021 Va Disability Rates Pay Chart Cck Law

2022 Va Disability Pay Chart And Compensation Rates Cost Of Living Adjustment Cck Law

Military Retirement Pay Calculator Military Onesource

Service Disability Retirement Calpers

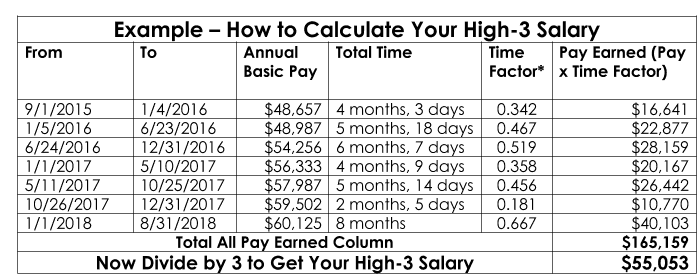

How To Calculate Your High 3 Salary Plan Your Federal Retirement

Military Compensation Pay Retirement E9with30years

Retirement

How Much Can You Get In Social Security Disability Benefits Disabilitysecrets

When Can I Retire This Formula Will Help You Know Sofi

E7 Retirement Pay Use The Military Retirement Calculator

Military Compensation Pay Retirement E9with30years

Updated For 2022 Va Disability Rates Charts And How To Calculate